by admin | Apr 8, 2014 | Archives

I have learned that I do my best at something when I have a plan and I practice. To start you have to have a philosophy, an idea or belief about your financial plan that you live by. When I sat for the Chartered Financial Analyst examination, there are three, I would...

by admin | Apr 1, 2014 | Archives

Recently I had a client approach me about buying a house in Denver, Colorado. They recently sold a house and are currently renting. The emotional draw is they want a second bathroom for their child. They want a big enough space for the child to feel comfortable. ...

by admin | Apr 1, 2014 | Archives

Well, we have a quarter of 2014 in the books and we appear to be going at a tortoises pace. Despite a bit of wavering volatility, US stock indexes went almost nowhere the first quarter of this year. Year to date, the Dow Jones Industrial Average™ is down a fraction...

by admin | Mar 21, 2014 | Archives

Looking over the economic landscape is not very comforting these days. As I drive around, I hear ads that you can get a mortgage for “more home than ever” now. Really? Wasn’t the lesson of 2008 that we need to figure how much someone can safely afford? Getting more...

by admin | Mar 12, 2014 | Archives

We live in a world in which trades occur at lightning fast speeds, literally measured in milliseconds. Yet, our goal is to be so careful that we do not have any mistakes to fix. Capstone has not made a trading error during 2013, or any year to date this year. However,...

by admin | Feb 14, 2014 | Archives

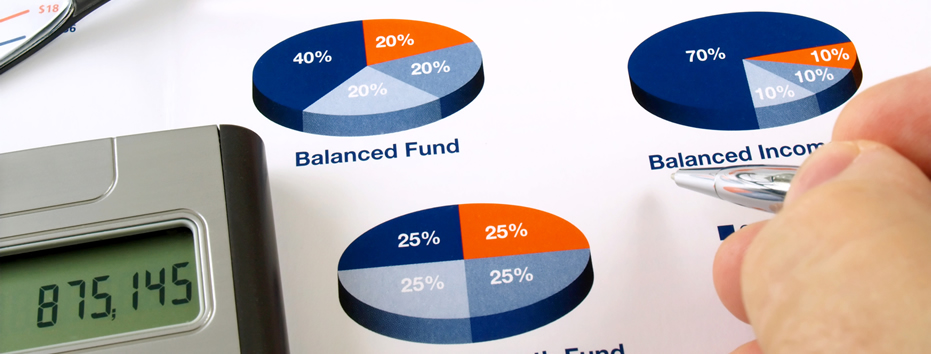

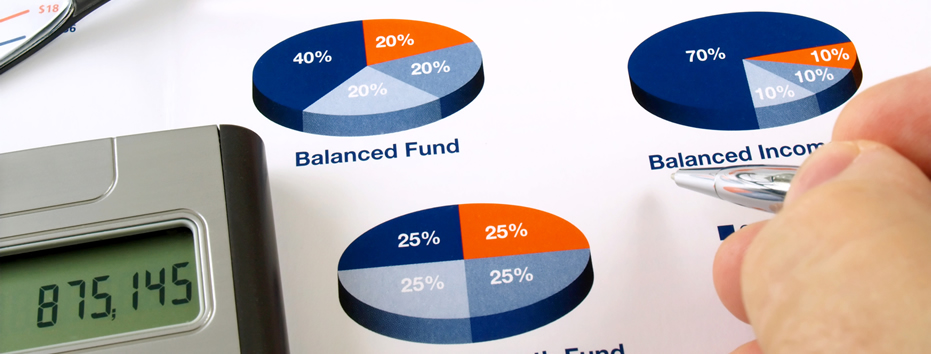

Like so many advisors and investors, we struggle daily with the low interest environment and the search for returns in the fixed income portion of portfolios. The reason people own fixed income historically is to reduce the volatility of their investment portfolio...