At Capstone, we use two procedures to address the benefit of value:

1) Relative Strength – “Measure of a stock’s performance compared to other investments.”

(Smarter Investing in Any Economy: the Definitive Guide to Relative Strength, Michael J. Carr, W&A Publishing 2008.)

2) Economic Risk Management – “There is no way of knowing when certain things will occur, but measuring the degree of downside potential that may develop when the economy is growing versus decelerating can help gauge the level of risk involved with certain investments.”

(Indicator of Business Expansion and Contractions, G.H. Moore and J Shiskin, National Bureau of Economic Research 1967.)

Adopting each of these strategies gives us reassurance that we are not just investing on “feelings.” Our optimism is based on significant research and trust that an investment of both time and research will pay off.

Portfolio Management Discipline

The MaxBalanced portfolio is based on the US endowment model, popularized by Yale University’s David F. Swensen. The origins date back to the British economist, John Maynard Keynes, who managed King’s College endowment from 1921 to 1946 in Cambridge, England. During this tenor, Keynes achieved an Alpha, the excess return over a benchmark, account for volatility.

The vital principals Keynes and Swenson attribute are a focus on value, contrarian thinking, active risk management and diversification. Each principal is described below:

- Value – Purchasing an investment with a stream of cash flow or dividends that is greater than the current price of a stock. (Additional information found in Security Analysis by Benjamin Graham and David Dodd, McGraw Hill, 1934.)

- Contrarian – Investing in things that are out of favor, but tend to be selling for a discount. (The Intelligent Investor, Benjamin Graham, Harper and Collins, 1949.)

- Risk Management – Comparing over- or underweight investments to the benchmark in order to take advantage of higher dividends or “on sale” investment that are relative to the benchmark. (Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor, Seth Klarman, 1991.)

- Diversification – Buying into multiple investments that behave differently at various times, thus reducing the risk of a sudden decline in value. (7Twelve: A Diversified Investment Portfolio with a Plan, Craig L. Israelsen, Ph.D.)

By combining these philosophies, an important dimension is added to the portfolio, as we do not know what we will see in the future. Connecting the principals also allows us to take advantage of how each investment will perform differently in the portfolio.

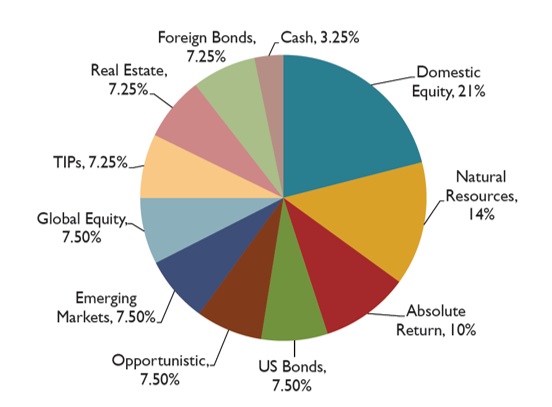

The MaxBalancedSM Account may invest in domestic stocks — small, medium, large; international stocks — developed or emerging; US bonds, including TIPS; non-US bonds; currencies; real estate; natural resources and commodities, as well as absolute return strategies.

The benefits offered by super-diversification provides an opportunity to add return and decrease volatility simultaneously, through ownership of low correlation assets.

History has shown us that high diversification delivers the potential to increase returns.

The ETF Aggressive, Growth, Moderate, Conservative and Income strategies are based on valuation, momentum, and economic risk management.

Hypothetical Allocation

Portfolio holdings are subject to change and should not be considered investment advice.

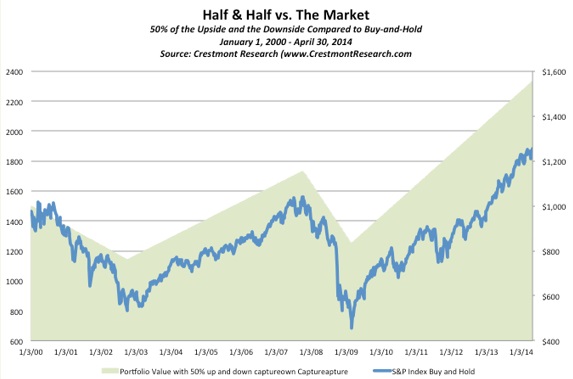

One major benefit to investors is managing risk and attempting to reduce

large losses.

Source: Ed Easterling Crestmont Research: This is hypothetical results only intended to prove a point. You could not determine if and when the market only declined by 50%. You could not have invested in this combination of investments. The S&P 500 is and index created by S&P Dow Jones Indices and cannot be invested in directly. It is intended as a benchmark to describe the actions of the U.S. Stock Market.