By Ryan Turbyfill, MBA Financial Advisor

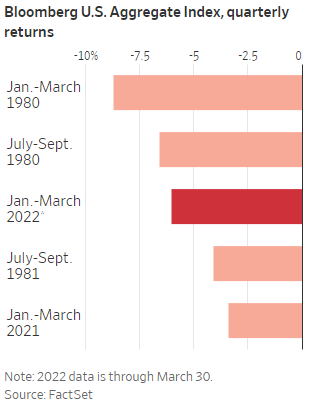

It has been a wild start to 2022 with the worst quarter in over 40 years for the bond market as interest rates surged, inflation remains very high and the tragedy in Ukraine. This past Friday the 22nd, the Dow Jones Industrial Average dropped 981 points, worst day since October of 2020. As I wrote late last year, we still have a conundrum around the markets, but it has shifted quite a bit in a short time. Economist Mohamed stated, in the current environment, it is the “cleanest dirty shirt” effect and finding the best options for the right risk and time horizon; I’ll explain.

Last fall, we reduced our exposure to corporate bonds and increased treasury inflation protected bonds (TIPS), floating rate loans and preferred stocks as the writing was on the wall that interest rates were going up. This helped with some of the drop in the bond market, but certainly not all.

In late November, mortgage rates were at mid to low 3% range and the10-year Treasury at 1.48%. As I am writing this now, 30-year mortgage rates are over 5% and the 10-year Treasury rate is at 2.91%. The Federal Reserve has said they are going to continue the rapid pace of raising rates to combat inflation, how much of those future hikes are already priced into the current market already is TBD. Many analysts feel that at the end of 2022, the 10-year Treasury will be between 2.5-2.75%, so maybe a lot of upcoming hikes are priced in?

With that, the Capstone Investment Committee has decided to start buying longer term bonds again for the first time in quite a while and we are reducing our floating rate loans and preferred stocks that we increased last year. The reason being, is that these types of investments hold more credit risk, and we feel that risk is increasing from last year. Now the good news with higher interest rates is that we are now seeing some opportunities for meaningful income on investments that is has been absent for almost two and half years.

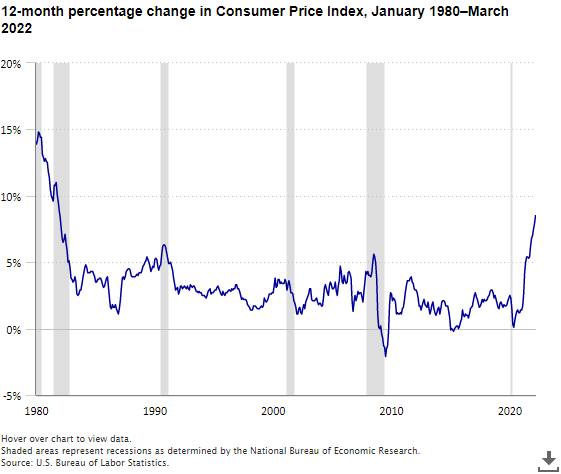

Inflation also remains front of mind, the Consumer Price Index (CPI) for the year ending March 2022 has increased 8.5%, the largest increase since December of 1981. This makes an argument to not hold a lot of cash as the current inflation is eroding the value of cash quickly. However, having some with the current volatility, helps avoid some of the whiplash, but also keeps dry powder for when opportunities present themselves.

Now for stocks, we have always had a strong tilt towards value stocks, those that have strong balance sheets and low to reasonable valuation for the price of the company. We have avoided the speculative sector which have taken a massive hit such as Ark Funds ARKK which is down 44.5% year to date as of this writing. Owning companies that can survive economic downturns, while paying dividends are areas we have always liked and even more so now.

Currently company earnings are coming out daily as we are in the middle of 1st quarter earnings season (20% have reported) and many are looking strong as 79% have exceeded estimates. Also, the unemployment rate is at an incredibly low 3.6%. However, there are many headwinds as soaring inflation is taking more of consumers paychecks for energy, groceries, and housing. At some point, this will limit other goods they can buy and may take a bite out of earnings. Also, with higher interest rates, companies will be less likely to expand at the rate they have the past year and possibly hire less, increasing the unemployment rate. We continue to look for areas that tend to do well with inflation, survive tough economic conditions and help reach your long-term financial goals.

We continue to look for risk and opportunities in the markets. Thank you again for trusting us during these unprecedented times and as always, please feel free to reach out to us anytime to discuss this further or long-term financial planning.