I have had more than one alarmed call recently-What should we do? Should we sell everything and buy gold? Is the market going to crash this fall? What are we going to do?

I have a few clients who, impervious to the fear and greed that sidetracks most investors, call when the market drops and offer to add some money to their accounts. The same conditions that trouble many clients are seen as an opportunity by some others. When I complimented one of my favorite clients about her opportunistic approach, she said to just get their attention by the headline “Sale!”.

It got me thinking about the strange way our brains handle money. It is true that people flock to sales to get something cheaper. It is also true that people sell their investments when they are falling and buy them after they have risen a great deal. In fact, they buy when they are marked up due to demand and sell when they are on sale. This odd phenomenon is referred to as “herd mentality”. It comes from somewhere in the primeval part of our brain.

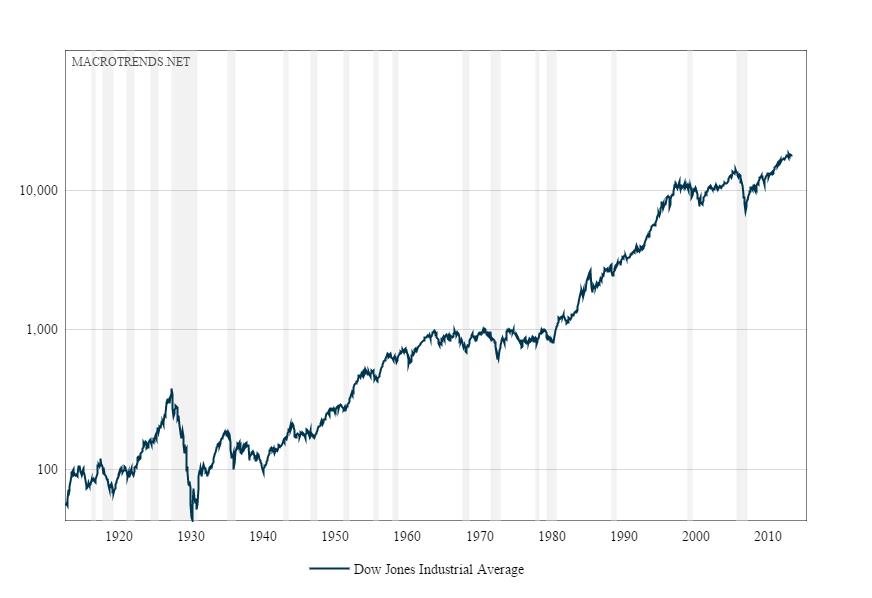

In twenty some odd years in this business, I have trained myself to overcome the fear and greed. I try to see market pullbacks as a buying opportunity and see high market valuations as a caution sign. However, that does not mean I have been able to turn off the primeval part of my brain. The pit of my stomach still churns when the market falls several hundred points and the “experts” are on TV predicting cataclysmic times ahead. Ultimately, I call on the rational part of my brain to override my churning stomach. I focus on this (there are no guaranties in life, but….this is what we call an upward bias!!!!!):

By Ted Schwartz, CFP®