By Ted Schwartz, CFP®

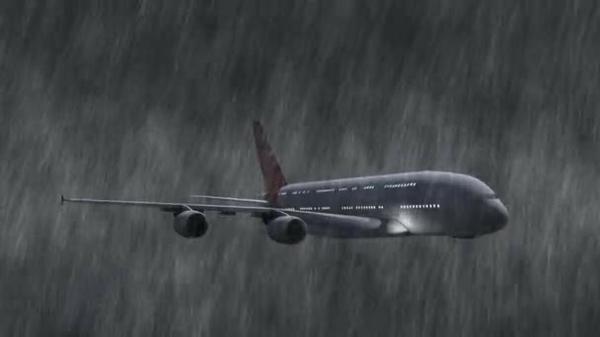

Chances are, you have been a passenger on a plane that experienced some turbulence. Most likely, your pilot asked you to return to your seat and to fasten your seat belt. Your pilot may have tried a mid-course change, flying at a different altitude to see if the air was calmer. Ultimately, the turbulence may have gone away fairly quickly or you may have had a rough flight most of the way. Ultimately, in my experience, I have always reached my destination.

I suspect I am a pretty average traveler. I do not love flying nor am I a “white knuckler”, who approaches flying with a sense of dread. During a turbulent flight, I have an unpleasant experience and feel uneasy. Others may have feelings that range from being totally unphased to a feeling of discomfort and perhaps even a resolve to not fly again. Within a very short time of arriving at my destination, I feel fine and go about my life as if nothing had transpired. So, for me the event is ultimately unimportant in getting me from my starting place to my destination.

The key to success in this is not what happens after turbulence is encountered. It is what has happened prior to the rough patch that is important. First and foremost, the plane was built to endure turbulence and also had safety features built in to its design. Your pilot has training and experience in handling turbulence. Even I have experience from other turbulent flights and know what to expect which helps calm me a bit.

Yes, I am going there! Your portfolio is your plane and we have tried to build it to endure difficult times. Diversification is the reinforced body of your portfolio. Turbulence is market volatility and/or a market correction. Capstone is your pilot and we have considerable combined experience here at dealing with difficult markets. Your destination is the achievement of your financial goals.

If planes were built only for speed or only for comfort with no thought of durability or safety, I would not care to ever fly again. The analogous portfolio to such a plane might look like this. Before the dot.com bubble burst, such a portfolio would have been a non- diversified collection of “high flyers” (stock like webvan.com, pets.com, etoys.com, etc.). These stocks all soared in value, then crashed and burned when turbulence arose. You simply could not get to your destination in 2000-2001 by owning these stocks. You had to jettison your portfolio or suffer the consequences.

So, if you are wondering why we are not currently doing more to combat this volatile market, the answer is we have tried to be proactive and to build you as durable a portfolio as we can. We may make a few mid-course corrections as we go through the turbulence but…the critical part of our work is done before we even hit the turbulence. While we have no guaranties of the future, our diversified portfolios have withstood considerable turbulence in the past and still allowed clients to achieve their goals. If you feel that the volatility is too much for you, maybe you need to fly at a bit lower altitude or a bit slower speed. Please contact us and schedule a review and meeting to look at the risk in your portfolio and make sure that it aligns with both your comfort level and your financial goals.