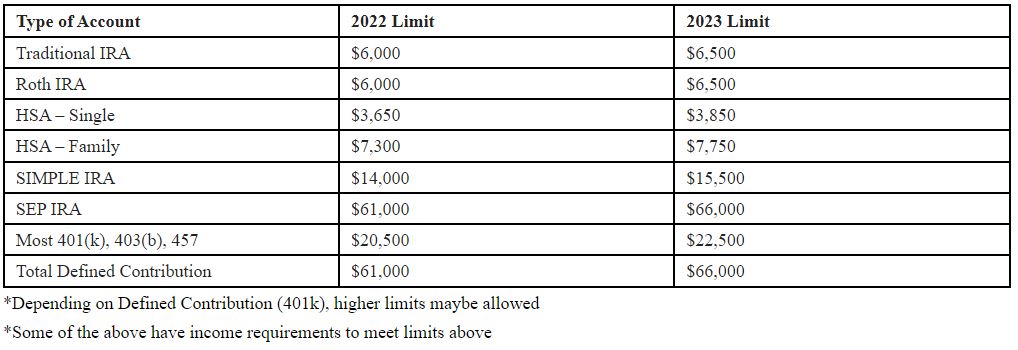

The IRS just announced increases to retirement plan contributions for 2023. We will see some large increases, much due to the high level of inflation.

Below are the increases per the IRS for 2023:

The IRS allows a “catch up” contribution of an additional $1,000 to those 50 and over, which didn’t change from 2021, $3,500 for SIMPLE IRA and an extra $7,500 in a 401(k) up which is unchanged from 2021 as well.

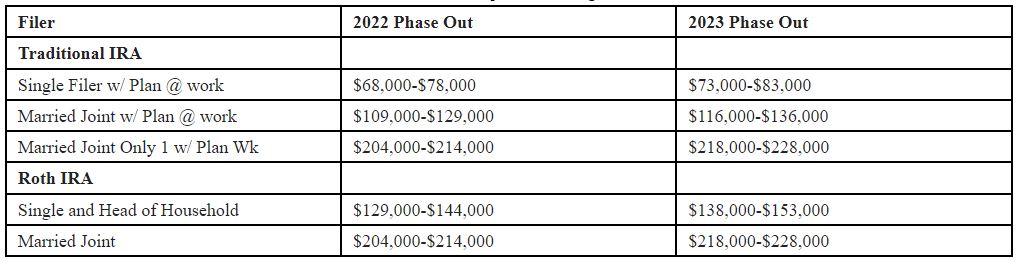

IRA’s have income limits for who can contribute and those income phase-out ranges have also been increase.

As always, would love to talk with you about how to implement these changes into your financial plan to provide a clear path to your financial goals.

**This is not deemed to be Tax or Legal Advice**