Capstone Investment Financial Group

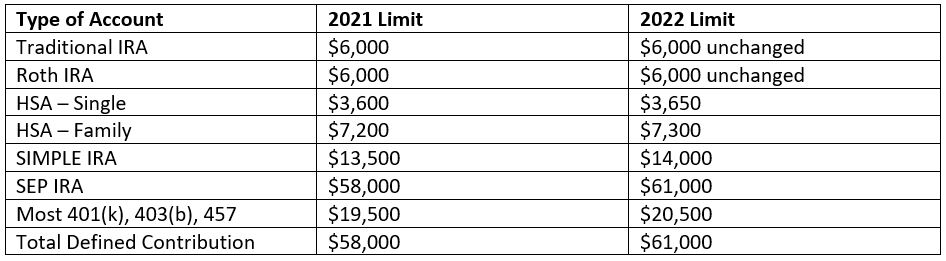

IRS just announced increases to retirement plan contributions for 2022. Some didn’t increase, others did slightly.

Below are the increases per the IRS increase for 2022:

*Depending on Defined Contribution (401k), higher limits maybe allowed.

*Some of the above have income requirements to meet limits above.

The IRS allows a “catch up” contribution of an additional $1,000 to those 50 and over, which didn’t change from 2021 and an extra $6,500 in a 401(k) up which is unchanged from 2021 as well.

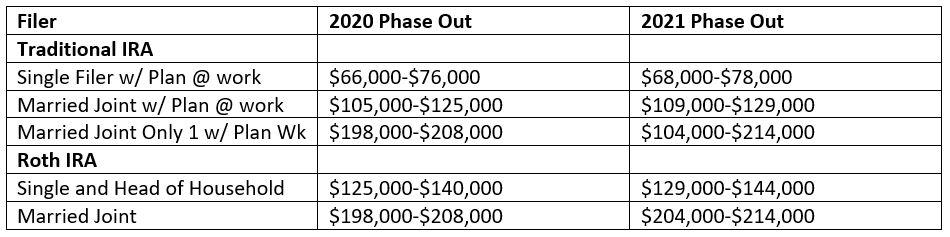

IRA’s have income limits for who can contribute and those income phase-out ranges have also been increased.

As always, we would love to talk with you about how to implement these changes into your financial plan to provide a clear path to your financial goals.

**This is not deemed to be Tax or Legal Advice**