We only wear one hat at Capstone-the fiduciary one!

We have taken the road of being an investment advisor and not affiliated with a broker/dealer and we are not licensed to sell insurance products. Why have we chosen to pursue this path? Simply put, we want to be under the fiduciary standard where we clearly put the client’s best interests first and are as free as possible of conflicts of interest. This is a difficult standard to meet, but we feel it is a worthy one to try to meet every day when we come to work.

There are many people in our industry who wear multiple hats-sometimes serving as your advisor in a fiduciary capacity and sometimes selling you financial products in return for commissions. We tried this road ourselves on our journey, but ultimately did not feel that it suited us as well as the Investment Advisor-only path. There are many great people who pursue this hybrid model, but we feel the clear path is to only serve as an advisor.

While we are in the business of giving advice to clients in return for compensation, representatives of broker/dealers are in the business of security transactions and it is considered that any advice they render is “incidental” to their business. This is, on the face of it, absurd. Nobody who is a client of a representative truly believes that their advice is “incidental”. Literally, you go to these people for their expertise and rely on their advice. Can you imagine if there were doctors who were guided by the Hippocratic Oath and others who were not? These others would perform medical procedures but would not be responsible for acting in your best interest as a patient?

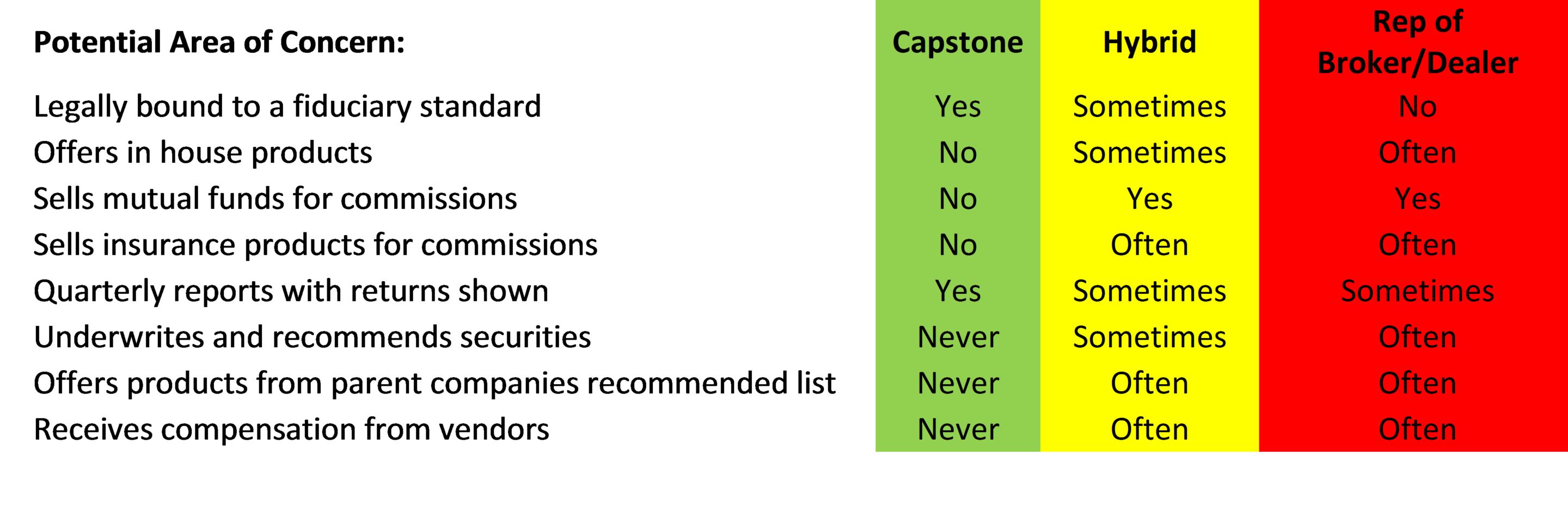

As many people who are licensed under the Securities Act of 1934 also offer advice for fees under the Act of 1940 in which they are a “hybrid” of advisor and security salesperson, here is a table that may show some of the differences you can expect as a client and areas that you may need to inquire about. The third column refers only to those professionals who do not offer advice under the Investment Act of 1940.

It is easy for us to understand why the public has a low opinion currently of brokers. Raising the entire profession to a fiduciary standard would elevate the quality of the field and would begin to provide the public with the environment that it deserves. Until that happens, we choose to confine ourselves to the advisory side of the business only, making clear that we are acting as fiduciaries at all times.

It is easy for us to understand why the public has a low opinion currently of brokers. Raising the entire profession to a fiduciary standard would elevate the quality of the field and would begin to provide the public with the environment that it deserves. Until that happens, we choose to confine ourselves to the advisory side of the business only, making clear that we are acting as fiduciaries at all times.

Obviously, we believe there should be a Uniform Fiduciary Code for anyone who is entrusted with the money of others. Clients cannot and should not be charged with figuring out what hat people are wearing-are they advising me on my best interests or just transacting securities with me. At the same time, those in this business should be willing to accept the responsibility for their actions should they fall short of meeting fiduciary standards.